Author Archive

Pelham Trust Building Historical Designation Hearing

The Pelham Trust building, most recently Santander Bank, is ripe for redevelopment. Apparently, it is currently unprotected by historical designation. Please read the email below for details of how to share your opinion of the relative importance of this historical building.

ACTION NEEDED: The former Pelham Trust Company at 6740 Germantown Avenue will be up for designation at the next meeting of the Philadelphia Historical Commission on 6/10/22 (meeting details below) Without designation, this impressive banking house, situated on a large lot and zoned for an apartment house, could be demolished with no discussion. Please call in to the Philadelphia Historical Commission meeting next Friday or send an email of support (details below). Community input is critical!

The Pelham Trust is listed as Significant in the Germantown Avenue Historic District, which is on the National Register and a National Historic Landmark, but not protected by the city. The Pelham Trust was nominated pro bono by the Keeping Society of Philadelphia. Please consider making a contribution at www.KeepingPhiladelphia.org

To offer written comments prior to the meeting, send an email to preservation@phila.gov. Written comments received before Thursday, June 9 at 12:00 noon will be forwarded to the Commission members.

The nomination for the Pelham Trust is below:

https://www.phila.gov/media/20220406083714/6740-Germantown-Ave-nomination.pdf

The details of the meeting are below:

Philadelphia Historical Commission

Meeting of Friday, June 10, 2022

9:00 AM | Remote Meeting on Zoom Webinar

Agenda: https://www.phila.gov/media/20220603105454/Historical-Comm-agenda-20220610.pdf

The Historical Commission will hold its June 10, 2022 meeting remotely using the Zoom Webinar platform. You can watch/listen and speak during the live meetings using your computer, tablet, or smartphone on Zoom. You can listen and speak during the live meetings on your telephone.

The meeting agenda, applications, nomination materials, and recent meeting minutes are available on the Historical Commission’s Public Meetings page. The Historical Commission will consider adopting the minutes of its most recent meeting at the upcoming meeting. The advisory committee minutes are not formally adopted, but are considered drafts until reviewed by the Historical Commission at the meeting.

To watch the meeting live on Zoom using your computer, tablet, or smartphone, click on the following link on June 10.

Link: https://bit.ly/phcjun10

Meeting Password: 242654

To listen to the meeting live on the telephone, call this number on June 10.

Telephone Number: 1-301-715-8592

Meeting ID: 879 2090 6096 #

Participant ID: #

Meeting Password: 242654

After the meeting, you can watch a recording of the meeting (and other earlier meetings) on the Recordings page of the Historical Commission’s website.

Happy Pride Month!

WMAN is committed to actively working to foster programs and spaces to support and celebrate the gender and sexual diversity in our community.

If you’re looking to find ways to celebrate Pride, please see the links below, or if you’d like to share a particular Pride Event in our newsletter, please email us @westmtairyneighbors@gmail.com

The Mayor’s Office of LGBT Affairs kicks off Pride Month in Philadelphia by hoisting the rainbow flag at City Hall, where it will fly all month long alongside state and city flags. Speakers and live music accompany the ceremony. Friday, June 3, noon.

Northeast apron of City Hall, 1400 JFK Boulevard.

https://www.

https://www.inquirer.com/

https://www.thrillist.com/

How to look up your 2023 property real estate tax assessment

To calculate what you can expect to pay in January 2023:

1. Go to https://property.phila.gov (It says “searching by owner” has been disabled. So far, not so.) Enter your property address in the box above the map area.

2. The “Assessed Value” of your house will appear under your name. If you scroll down, you will see the valuation history, as well as a detailed description of your property.

3. To calculate how much you will owe in property tax in January 2023, take the assessed value up top and multiply it on a calculator by .013998% (the “millage rate.) NOTE: This total may be lower if you qualify for a “homestead exemption” or other factors. City Council has not finalized the Budget for 2023 and as a result the amount of the “Homestead Exemption” and other special relief programs may change.

4. Or go to this page at Community Legal Services and simply enter your address in the middle of the page at the Property Tax Estimate Calculator. https://clsphila.org/housing/property-tax-calculator/.

Deadlines:

The deadline to file a formal appeal with the Board of Revision of Taxes is on or before Monday, October 3, 2022. Even if a First Level Review is filed, a response is not likely to be made by the October 3rd deadline.

Here are additional articles below on how to appeal your valuation.

Check out the interactive map in the following Philadelphia Inquirer article. Here are some average property assessment increases by neighborhood that may surprise you:

– West Mount Airy + 50%

– Chestnut Hill +30%

– North Philadelphia East +133%

– Center City East + 1%

– Manayunk +18%

– Kensington +150%

A few other relevant articles:

‘It’s wrong’: Philly property assessments double in some working-class neighborhoods

The property assessments are Philadelphia’s first since 2019. The mayor and City Council are negotiating relief options for homeowners hit by increases.

What you need to know about Philly’s 31% property assessment spike

https://www.inquirer.com/news/philadelphia/philadelphia-property-assessment-taxes-20220509.html

Philly’s new property tax assessments: How to challenge your new valuation

https://whyy.org/articles/phillys-new-property-tax-assessments-how-to-challenge-your-new-valuation/

Philly delayed property assessments for three years. Now residential values are jumping 31%.

https://www.inquirer.com/politics/philadelphia/philadelphia-property-tax-assessments-increase-mayor-jim-kenney-20220503.html

City Completes Property Reassessments, Unveils Plans to Expand Relief Programs and Reduce Wage Taxes

https://www.phila.gov/2022-05-03-city-completes-property-reassessments-unveils-plans-to-expand-relief-programs-and-reduce-wage-taxes/

The Black homeownership gap in Philadelphia

https://stacker.com/pennsylvania/philadelphia/black-homeownership-gap-philadelphia

by Jane Century

Vote for Mount Airy Baseball Player as Big 10 Player of the Year!

Chris ” Bubba” Alleyne played Mount Airy Baseball for six years, including several seasons of STARS tournament teams. He graduated from Springside Chestnut Hill and is now a senior outfielder batting .354 at the University of Maryland. Chris is a semi-finalist for Big 10 Player of the Year award.

Please take a minute to read his profile and vote for him (early and often is encouraged!). Share the link so we can help Chris win!

https://www.usabaseball.com/golden-spikes-award/nominees/2022

Simple Statement of Solidarity with Ukraine: Flower Power!

With the world as crazy as it is, we can all use small reminders of how lucky we are to live in our beautiful, relatively safe community of West Mt. Airy, especially in light of the atrocities taking place in Ukraine. Will you join WMAN in our effort to cover Mt. Airy in sunflowers to show our solidarity with the Ukrainian people, while adding a little more brightness and beauty to our community? Knowing that the sunflower is Ukraine’s national flower, our generous neighbors at Germantown Kitchen Garden and Primex Garden Center have donated thousands of sunflower seeds to our effort. We encourage individuals and businesses to pick up seeds from 258 W. Gorgas Lane or from FarmerJawn at 6730 Germantown Avenue. We look forward to seeing our community blanketed in hues of yellow!

Mt. Airy Traffic Calming Committee: Please join us, or at least slow down when you’re driving around the neighborhood!

Are you increasingly concerned that a reckless driver might hit you? Do you wish you could let your kids walk to school on their own without worrying about their safety?

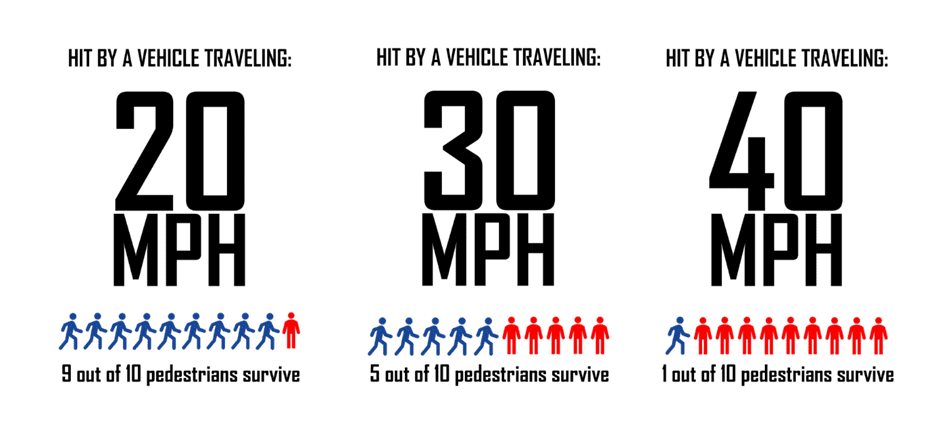

It is not your imagination: reckless and aggressive driving has gotten a lot worse in the past few years. Traffic crash fatalities nationwide have risen over the past decade. Paradoxically, crash fatalities dramatically rose during pandemic lockdown when car-free residential streets allowed for reckless speeding throughout the country. With the end of lockdown, traffic fatalities unfortunately have not decreased as bad driving behaviors have become habits.

What can we as a community do to protect ourselves and our children? One answer is traffic calming. Traffic calming is the installation of measures which force drivers to slow down. Speed cushions, sidewalk bump-outs, parking protected bike lanes, re-striping road “diets”, and automated speed-cameras are some of the most effective measures to make our streets safer for people not traveling by car.

Some of the most innovative and effective traffic calming tools are parking protected bike lanes (which buffer pedestrians from traffic) and automated speed-enforcement cameras. But neither is even available for our most dangerous roads (Lincoln Drive, Stenton, Upsal, and Ardleigh) because they are only pilot programs or need additional legislation to make them available citywide. According to speakers at Philadelphia’s Vision Zero Conference on April 30th, legislation allowing for speed cameras will sunset in 2023 and a parking protected bike lanes bill (HB 140) is currently stuck in the Senate Transportation committee in Harrisburg. They will need broad public support to be put into expanded use.

Street cushions are a tried-and-true traffic calming measure that we’ve seen installed on a handful of streets in the neighborhood. Getting speed cushions on your street can be a drawn-out and complicated process. Only certain wide streets are even eligible for speed cushions. Moreover, large “arterial” streets like Lincoln Drive are prohibited from installing speed cushions at all because of the need to maintain higher commuting speeds. Even eligible streets require Philadelphia to conduct a traffic study and need councilperson backing, in addition to overwhelming neighborhood support.

In the meantime, what is a Mt Airy resident to do? Well, for one thing – you can SLOW DOWN when driving! Even when you are late to work or in a hurry.

Second, you can JOIN the Mt. Airy Traffic Calming Committee – a joint project of WMAN and EMAN. We are currently working on many strategies to make Mt Airy safer for all of us, but it’s a heavy lift, and we need as many hands as possible. Please email anne.dicker@gmail.comif you are interested in being part of the solution.

Image: Vision Source Network

Did your property taxes go up? Here are some things you can do.

Philadelphia released new “assessments” of property values, which they will use to calculate 2023 property tax bills. If your assessed value went up, your property taxes will, too. Based on the current tax rate, for every $10,000 in increased value, your yearly tax bill will go up by $140. To estimate your 2023 property tax, visit our Property Tax Calculator.

If you think your new home assessment is too high, you should appeal right away. You can do that by requesting a “First Level Review” with the Office of Property Assessment, and filing an appeal with the Board of Revision of Taxes by October 3, 2022. Learn more at the Philadelphia Office of Property Assessments.

Most Philadelphia homeowners qualify for at least one tax relief program.

First, see if you qualify for Longtime Owner Occupants Program (LOOP), which was designed for homeowners who have lived in their home for at least 10 years, and have seen their home’s assessed value increase by at least 50% this year. Most homeowners do not qualify for LOOP, but if you do, you should apply because it will lower your taxes more than the Homestead Exemption Program will. To see if you qualify for LOOP, visit the City’s website.

Next, if you do not qualify for LOOP, you should enroll in the Homestead Exemption Program. This program is available for every Philadelphia homeowner, including people who are dealing with tangled titles, except for people who are enrolled in LOOP. Currently, the Homestead Exemption saves Philadelphia homeowners around $629 on their yearly tax bill.

Third, you should enroll in the Senior Freeze, if you are 65 or older (or 50+ and the widow(er) of someone who was 65 or older when they died) AND you are low-income (less than $33,500 for a household of 1 or $41,500 for a household of 2). You can be enrolled in the Senior Freeze and the Homestead Exemption Program at the same time, so be sure to apply for both.

Fourth, you should apply for the Senior Tax Rebate. This Pennsylvania program benefits homeowners age 65 and older; widows and widowers age 50 and older; and people with disabilities age 18 and older. The income limit is $35,000 a year for homeowners and $15,000 annually for renters, and half of Social Security income is excluded. Homeowners can receive a rebate of up to $975, depending on their income. You can apply for the Senior Tax Rebate here.

Finally, you should enroll in an Owner-Occupied Payment Agreement (OOPA) if you have a tax delinquency or can’t afford to pay your taxes.

You can apply for any City tax relief program on the City of Philadelphia website.

If you are already enrolled in any of these programs, you do not need to re-apply each year.

There are additional tax relief programs offering specific help to veterans or to others.

“Ownership” for all tax relief programs includes people with tangled titles. This means that your name does not need to be on the deed to enroll. For example, if you inherited your home from a family member or if you have a rent-to-own agreement, you are eligible for these programs. That said, homeowners with tangled titles should apply with the help of a housing counselor or lawyer.

To learn more about these programs, get legal help, or find links to apply, visit www.clsphila.org/